China Trademark Subclass System: What Foreign Applicants Need to Know

Over 70% of trademark issues for foreign brands in China stem from misunderstanding one key concept: the subclass system. Unlike most jurisdictions, China determines trademark similarity and conflict primarily at the subclass level, not just the broader international class. This guide explains this critical system and how to navigate it successfully.

1. Why Every Foreign Business Must Understand the China trademark Subclass System

From handling hundreds of trademark cases, I can tell you the most common source of trouble is the “subclass” system. Foreign clients often face confusing refusals and conflicts because they think in terms of broad international Nice Classes, while the China National Intellectual Property Administration (CNIPA) thinks in subclasses.

🎯 The Core Issue:

In China, similarity is determined mainly by the subclass, not the Nice Class. This is a fundamental difference from the U.S., EU, UK, and most other jurisdictions. If your brand is registered in the correct class but the wrong subclass, you may still face opposition from a similar mark in a different subclass within the same class.

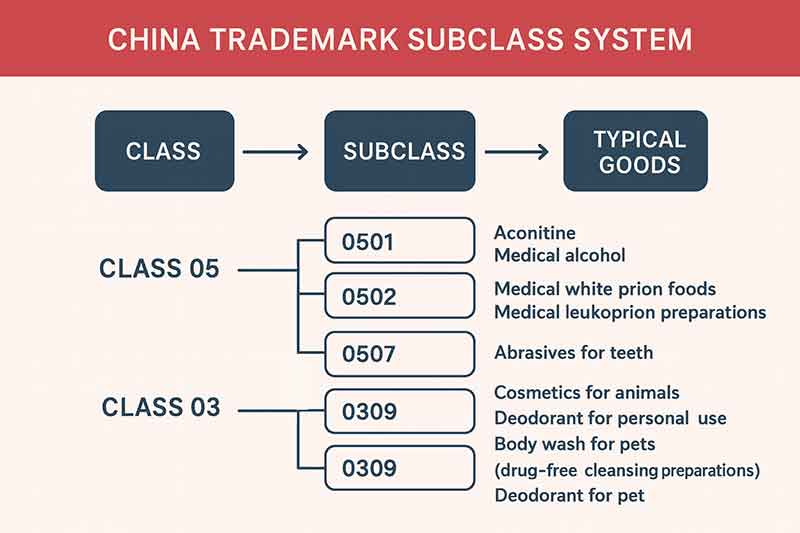

2. What Exactly Is a trademark Subclass in China?

China follows the international Nice Classification system (45 classes for goods and services). However, CNIPA further divides each of these 45 classes into numerous subclasses.

- A subclass is China’s internal rulebook for determining if goods or services are similar.

- Each subclass has a code (e.g., 0907) and contains a specific list of core goods, related goods, and similarity guidelines.

- The system was created to make examinations more accurate and efficient, reducing unnecessary conflicts in overly broad categories.

In simple terms: For trademark conflict examination in China, the subclass is the real battlefield.

3. How China trademark Subclass System Works (Practical Breakdown)

Let’s look at a simplified example within Nice Class 9 (Scientific apparatus):

| Nice Class 9 | Subclass Code | Typical Goods |

|---|---|---|

| Scientific Apparatus | 0907 | Computers, laptops, servers |

| 0908 | Speakers, headphones, audio devices |

The Critical Difference: In the U.S. or EU, these items are often considered part of the same “electronics” category. In China, they fall into different subclasses. This means a trademark registered only in subclass 0907 may not automatically block a similar mark from registering in subclass 0908, even though both are in Class 9.

4. Why Subclasses Matter So Much (Real Risks for Foreign Applicants)

Misunderstanding subclasses leads to concrete, costly problems. Here are the most common patterns I see:

🚨 Risk 1: Incomplete Coverage Invites Bad-Faith Filings

A brand registers only its core subclass. A local entity then registers the identical brand in an adjacent, uncovered subclass, creating a legal block.

Real Consequence: Unable to sell related products, e-commerce listing refusals, factory production halted due to infringement risk.

🚨 Risk 2: Functional Similarity Trumps Subclass Numbers

Goods in different subclasses can still be deemed “similar” if their function, use, and consumers overlap (e.g., smartwatches vs. smart wristbands).

Real Consequence: Unexpected refusal of your application based on a prior mark you thought was unrelated.

🚨 Risk 3: Literal Translation Leads to Wrong Subclass

Foreign companies often translate their goods literally. CNIPA classifies based on function and use, not translation. Choosing the wrong subclass triggers unnecessary conflicts.

Real Consequence: Application refusal, wasted time and fees, need to re-file correctly.

5. How CNIPA Determines Similarity (Based on Real Case Experience)

CNIPA examiners don’t just look at subclass codes. They use a multi-factor analysis. In my experience, these are the most critical criteria, in order of importance:

- Function and Use: The single strongest factor. If two products serve the same core purpose, they are highly likely to be judged similar.

- Sales Channels and Market Overlap: Goods sold through the same retail platforms, stores, or distributors are viewed as related.

- Target Consumers: Products aimed at distinct groups (e.g., children vs. medical professionals) are less likely to be similar.

- Official Cross-Search Rules: CNIPA publishes internal guidelines (《类似商品和服务区分表》) that explicitly link which subclasses should be cross-examined for similarity. These rules are paramount. The official version only provides the Chinese edition. To facilitate understanding by international users, we have provided the English version of the “Similar Goods and Services Classification Table.”

📝 Professional Insight: Many foreign applicants fail because they fixate on the subclass number alone. Winning an argument with CNIPA requires addressing these practical factors, not just the technical classification.

6. How Foreign Companies Should Choose Subclasses (Professional Advice)

Follow this strategic approach to build a robust trademark portfolio in China:

Start from Function, Not Name

Determine the subclass based on your product’s function, intended use, and consumer scenario, not its English name. Avoid literal translation pitfalls.

Cover Core + Adjacent + Cross-Search Subclasses

Protect your main product subclass. Then, proactively register in logically adjacent subclasses and any subclasses linked by CNIPA’s cross-search rules. This creates a defensive buffer against squatters.

Avoid Overly Broad Applications

While protection is important, applying for every subclass in a class increases refusal risks and can appear as bad-faith hoarding. Be strategic and relevant.

Conduct a Subclass-Specific Conflict Search

Before filing, search not just for identical marks in your class, but for similar marks in all related subclasses based on function and cross-search rules. This is a non-negotiable step.

Our other article, [China Trademark Goods & Services Classification Guide], provides a detailed introduction on how Foreign Applicants can correctly select subclasses, goods, and services.

Need Help with Your Subclass Strategy?

A precise subclass strategy is the foundation of strong trademark protection in China. Missteps can be costly. Get a professional opinion tailored to your specific products and business goals before you file.

7. How Subclasses Affect Real Trademark Outcomes (Case Studies)

Here are anonymized examples from actual client situations that illustrate the system’s impact:

Case 1: One Brand, Two Different Results

Scenario: A sports brand applied for “FLEXI” in Class 28.

Outcome: Approved in subclass 2802 (fitness equipment) but refused in subclass 2803 (ball sports equipment) due to a conflicting prior mark in 2803.

Lesson: Different subclasses within the same class are examined separately. A clean search in one does not guarantee clearance in another.

Case 2: Functional Similarity Overrules Different Subclasses

Scenario: A U.S. tech company applied to register its brand for “smartwatches” (subclass 0901).

Outcome: CNIPA refused the application based on a similar Chinese mark for “smart wristbands” (subclass 0907).

Lesson: Despite different subclass codes, CNIPA deemed the goods similar due to identical function, use, and consumer base. The subclass number is not a shield.

Case 3: Incomplete Coverage Leads to Brand Hijacking

Scenario: A European fashion brand registered its mark only in subclass 2501 (underwear), overlooking 2503 (sportswear).

Outcome: A local entity registered the identical brand in subclass 2503, successfully blocking the original brand from selling athletic wear in China.

Lesson: Failing to protect adjacent, commercially relevant subclasses creates dangerous gaps for bad-faith registrations.

8. Pros and Cons of China trademark Subclass System

Advantages

- More Precise Protection: Allows for targeted registration, avoiding over-broad monopolies.

- Potentially Lower Cost: You can file in fewer, more precise subclasses.

- Reduces Unrelated Conflicts: Minimizes oppositions from goods that are truly dissimilar.

- Streamlines Examination: Provides examiners with clear guidelines for consistency.

Limitations & Challenges

- Not Intuitive for Foreigners: A unique layer of complexity not found in most countries.

- Translation Inconsistencies: Relying on English-to-Chinese translation often leads to errors.

- Requires Local Expertise: Effectively navigating the system often demands professional help.

- Dynamic Updates: Cross-search rules and subclass interpretations can evolve.

9. Key Takeaways for Foreign Applicants

- Subclass > Class: In China, selecting the correct subclass is more critical than choosing the right Nice Class.

- Think in Terms of Function: Classification is based on a product’s purpose and use, not its name.

- Protect Proactively: File in your core subclass AND in commercially/logically adjacent subclasses to block hijackers.

- Respect Cross-Search Rules: CNIPA’s internal similarity guidelines are law. Your search strategy must account for them.

- Search Before You File: Conduct a thorough, subclass-aware clearance search to predict and avoid conflicts.

Mastering the subclass system is not about gaming a complex bureaucracy; it’s about understanding the precise framework China uses to define your brand’s protective boundaries. With the right strategy, you can secure robust protection and avoid the most common pitfalls that ensnare foreign brands.

China Trademark Agency Alliance

CTMAA is more than just a China tradmark registration service provider; we are your strategic partner for entering and establishing yourself in the Chinese market. We are dedicated to clearing obstacles, using our professionalism, experience, and integrity to safeguard your brand in China.